Cheap Auto Insurance in Las Vegas, Nevada

Serving Las Vegas, Henderson, North Las Vegas & All of Nevada

Doing our best in meeting your need for cheap Las Vegas Auto Insurance. With great service, fast auto insurance quote, convenience, and yes, cheap Las Vegas auto insurance.

We make it convenient with 6 locations and service over the phone. No one does it better. Call us for Cheap Auto Insurance Las Vegas

Todos de Representantes Hablan Español – Aseguranza para Carros en Las Vegas

Buy Over The Phone

702-907-0000

Cheap Las Vegas Auto Insurance

Let’s Do This!

Get Statred Now

702 907-0000

702 907-0000

Make Your Payment

Directly With Your Company

6 Las Vegas Locations

Find One Nearest You!

Hours

Monday to Friday

9:00am – 5:30pm

Saturday Closed

Sunday Closed

Call Us For The Best Rate

Let’s Do This! Let us work our magic to get you the lowest rate.

Make Your Payment Here

Make a Payment online conveniently. Or just give us a call.

Find a Location

6 locations to serve you.

Or just give us a call

for Directions

It’s that simple.

Business Hours

Monday to Friday

9:00am to 5:30pm

Saturday Closed

Sunday Closed

Everyone is looking to save a few bucks, and we’re right there with you. At Express Insurance, we strive to find the cheapest and most affordable auto insurance in Las Vegas, Nevada for our customers. We offer competitive rates on high-quality car insurance coverage.

Our team of insurance experts is dedicated to helping you find the best insurance policy for your needs and budget. With 6 Las Vegas locations and some of the cheapest rates around, we offer coverage options, including liability, comprehensive & collision coverage.

Get a free, no-obligation quote from Express Insurance today and see how much you can save on your car insurance! Protect your car and finances with reliable coverage from Express Insurance. If you’re in the Reno area, please visit our other website, Pronto Auto Insurance.

Everyone is looking to save a few bucks, and we’re right there with you. At Express Insurance, we strive to find the cheapest and most affordable auto insurance in Las Vegas, Nevada for our customers. We offer competitive rates on high-quality car insurance coverage.

Our team of insurance experts is dedicated to helping you find the best insurance policy for your needs and budget. With 6 Las Vegas locations and some of the cheapest rates around, we offer coverage options, including liability, comprehensive & collision coverage.

Get a free, no-obligation quote from Express Insurance today and see how much you can save on your car insurance! Protect your car and finances with reliable coverage from Express Insurance. If you’re in the Reno area, please visit our other website, Pronto Auto Insurance.

6 Las Vegas area locations and affordable Auto Insurance Companies

to find you cheap Auto Insurance in Las Vegas

6 Las Vegas area locations and affordable Auto Insurance Las Vegas

companies to find you the cheapest Las Vegas Auto Insurance in the city.

YES We Can!

No Drivers License

SR-22

New in State

Young Driver

Non-Owners

No Previous Insurance

Bad Credit

No Credit

Ticket or Accidents

Expired Drivers License

Matricula

International or Mexican License

…And We Can Do It Affordably

And Do We Have Discounts!

(if applicable)

Automatic Payments

Continuous Insurance Discount

Homeowner

Multi-Car

Multi-Policy

Paid in Full

Paperless

Advance Quote

Good Student

Senior Driver (safety course required)

Renewal Discount

Air Bag Discount

Five Year Claim Free

Three Year Safe Driving

Driver-Side Airbag

Smart Technology

Full Coverage

Anti-Theft Discount

Yes We Can!

No Driver’s License

SR-22

New in State

Young Driver

Non-Owners

No Previous Insurance

Bad Credit

No Credit

Ticket or Accidents

Expired Driver’s License

Matricula

International or Mexican License

…And We Can Do It Afordably

And Do We Have Discounts!

(if applicable)

Automatic Payments

Continuous Insurance Discount

Homeowner

Multi Car – Multi Policy

Paid in Full

Paperless

Advance Quote

Good Student

Senior Driver (safety course required)

Renewal Discount

Air Bag Discount

Five Year Claim Free

Three Year Safe Driving

Driver-Side Airbag

Smart Technology

Full Coverage

Anti-Theft Discount

What They’re Saying About Us!

Insurance Products

(Click on a Icon For More Details)

Auto Insurance

We offer a variety of coverage and companies for any driver. That’s right, ANY DRIVER in Las Vegas, North Las Vegas, Henderson, Boulder City, and the rest of Nevada.

Motorcycle

Motorcycle insurance covers the motorcycle from damage caused by an accident as well as liability to other vehicles or injury caused to another party.

Commercial Auto Ins.

Successful businesses understand the importance of reliable commercial auto insurance for their business vehicles.

Boat Insurance

What does boat insurance protect me against? A Boatowners Policy can insure you against most risks of owning and operating your boat, its motor and its trailer.

Auto Insurance

We offer a variety of coverage and companies for any driver. That’s right, ANY DRIVER in Las Vegas, North Las Vegas, Henderson, Boulder City, and the rest of Nevada.

Motorcycle

Motorcycle insurance covers the motorcycle from damage caused by an accident as well as liability to other vehicles or injury caused to another party.

Commercial Auto Ins.

Successful businesses understand the importance of reliable commercial auto insurance for their business vehicles.

Boat Insurance

What does boat insurance protect me against? A Boatowners Policy can insure you against most risks of owning and operating your boat, its motor and its trailer.

Homeowners

At Express Auto Insurance, we provide you extensive coverage’s for your home! Whether it needs to be repaired or rebuilt in the aftermath of a storm, or an act of vandalism, your homeowners’ policy has got you covered!

RV Insurance

What does the RV insurance cover? Most RV policies offer full coverage. This covers your RV no matter what happens and whose fault it is.

Renters Insurance

Renters insurance can protect your belongings in case of disaster. Renters face the same risk as homeowners in cases of disasters striking their dwelling.

Mexico Insurance

Various Mexico insurance laws will require you to purchase liability insurance from an insurer that’s licensed to provide coverage in Mexico which means your regular US auto insurance most likely won’t cover you.

Homeowners

At Express Auto Insurance, we provide you extensive coverage’s for your home! Whether it needs to be repaired or rebuilt in the aftermath of a storm, or an act of vandalism, your homeowners’ policy has got you covered!

RV Insurance

What does the RV insurance cover? Most RV policies offer full coverage. This covers your RV no matter what happens and whose fault it is.

Renters Insurance

Renters insurance can protect your belongings in case of disaster. Renters face the same risk as homeowners in cases of disasters striking their dwelling.

Mexico Insurance

Various Mexico insurance laws will require you to purchase liability insurance from an insurer that’s licensed to provide coverage in Mexico which means your regular US auto insurance most likely won’t cover you.

Looking for cheap Las Vegas car insurance? Express Insurance is your top choice for affordable auto insurance and discount car insurance in Las Vegas. Our dedicated team of experienced insurance agents will help you find the perfect coverage at a price you can afford.

As a Nevada resident, remember to obtain your driver’s license and register your vehicle within 30 days of moving. The initial fine for failing to register your vehicle is $1,000, which may be reduced to $200 upon compliance. Active duty military members and their families are exempt.

Express Insurance follows Nevada’s graduated licensing system for new drivers, including teenagers. Teens can apply for a State of Nevada Instruction Permit at age 15 1/2 and must be at least 16 to apply for a license. New drivers under 18 must complete a driver training course and log 50 hours of driving experience. Teen drivers face restrictions such as a ban on transporting passengers under 18 (except immediate family) for the first six months and a curfew from 10 PM to 5 AM.

As a Las Vegas insurance agency, Express Insurance ensures your insurance information is up to date with the DMV. We update your details whenever you change your cheap Las Vegas auto insurance policy. Bring your Evidence of Insurance or Insurance Declarations Page to our office to ensure accuracy. The name on the insurance policy must match the name on the driver’s license, and the Vehicle Identification Number must match the registration.

Before registering your vehicle, purchase your cheap Las Vegas auto insurance from Express Insurance. Present your Nevada Evidence of Insurance at registration and carry it along with your State of Nevada Certificate of Registration in your car at all times. Out-of-state insurance is not accepted; you must buy your Nevada car insurance from a licensed insurance broker in the state.

If you receive a notice from the DMV requesting insurance verification, don’t ignore it. Contact Express Insurance for assistance. Responding promptly can prevent suspension of your registration or a citation. You have 15 days from the notice date to respond. If the DMV confirms continuous coverage, the process is complete. If not, the DMV will issue a Certificate of Non-Compliance, which must be presented within 30 days to avoid registration suspension.

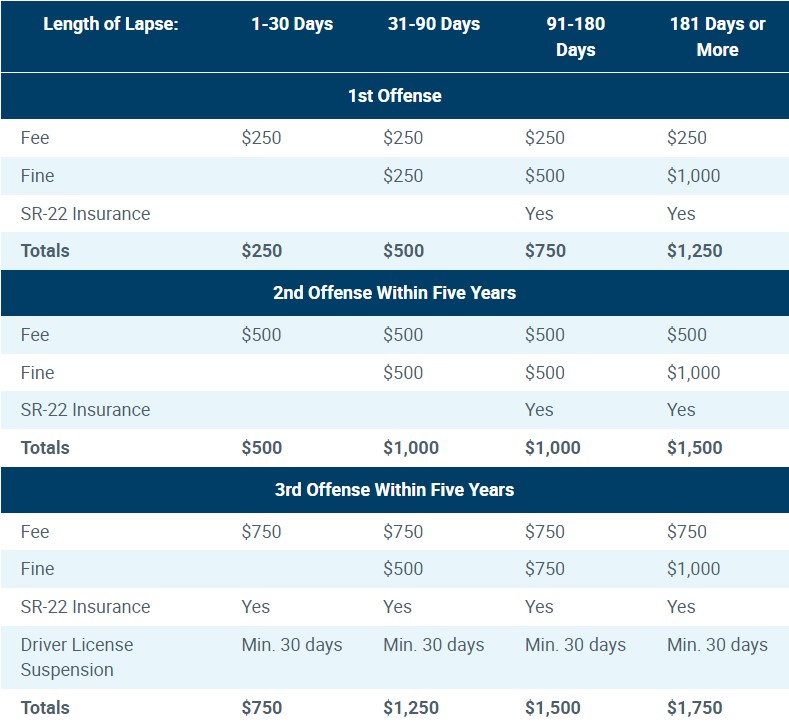

Below is the State of Nevada DMV penalties for not having insurance on your vehicle. They don’t play around, and the penalties are stiff. Call us!

Nevada Driving — What You Need to Know

New Nevada residents must obtain their driver’s license and vehicle registration within 30 days. The initial fine for failing to register your vehicle is $1,000. It may be reduced to not less than $200 upon compliance.

Residency Requirements

You must be a Nevada resident and provide a Nevada street address to obtain a driver’s license. You may not hold licenses or ID cards from multiple states.

Active duty military members, their spouses, dependents, and others living temporarily in Nevada are not required to transfer their license and registration.

Licenses are not issued to visitors. Foreign nationals may or may not be eligible for a license or a driver authorization card depending on their specific immigration status. Email or call for details and see Residency and Proof of Identity.

Nevada makes use of a graduated licensing system. In Nevada, Teen applicants may apply for a State of Nevada Instruction Permit when they are 15½ years old., and teens must be at least 16 years old to apply for a license. New drivers under the age of 18 must complete a driver training course, which consists of either online or in-class instruction as well as 50 hours behind the wheel.

Few Restrictions for Teen Drivers

A teen driver in Nevada is prohibited from transporting any passenger under the age of 18, with the only exception being immediate family, for the first 6 months they hold their driver’s license. Additionally, drivers under the age of 18 are not allowed to drive between the hours of 10 PM and 5 AM. Minors must also be aware of local curfews, most notably on Las Vegas Strip and the Reno Downtown Gaming District.

Most all 50 states have some kind of Graduated Driver Licensing (GDL). GDL is a program that gradually phases in driving privileges for new teen drivers, as they gain their experience behind the wheel. Express Auto Insurance offers some of the most comprehensive rates available for teen drivers, with multiple carriers giving great rates.

Your Insurance Information Needs To Be Updated

Here at Express Auto Insurance, we update your insurance information with the DMV anytime you purchase or make a change to your policy, especially if the policy number has changed or you change cars. You may or may not receive a verification request from the DMV if you don’t.

You will need your Evidence of Insurance or your Insurance policy Declarations Page. If you want to check to see your information updated you can do that here Insurance Policy Update.

At least one of the named people on the vehicle’s registration needs to be a named insured on your insurance policy and the name listed should match the name on the insured’s driver’s license. We also ensure the Vehicle Identification Number matches the one on the registration and the insurance policy.

You must purchase auto insurance before you register the vehicle. You must show your Nevada Evidence of Insurance at registration. You must also carry the card and your State of Nevada Certificate of Registration in your car at all times. Out-of-state insurance is NOT accepted and you must purchase your car insurance from a licensed insurance agent in the state of Nevada.

DMV Notice

You might receive a notice from the DMV asking you to verify your insurance coverage. Do not ignore this notice! Either call us, bring the card to one of your offices and we will help you with it. Your timely response will help prevent a possible registration suspension and/or law enforcement citation. You can also respond online or return the postcard even if you have sold the vehicle or moved out of state. If you wish to respond yourself do that here Verification Response

You must respond within 15 days of the notice mailing date. If the DMV can confirm that you have had continuous coverage, the process ends. If not, the DMV will issue a Certified Letter.

Nevada has no grace period. A one-day lapse in coverage will result in a registration suspension. Out-of-state insurance is considered a lapse. Please use the Insurance and Registration Status Inquiry to see what your current status is.

Registration Suspension and Reinstatement

If your coverage did lapse or the DMV cannot confirm your coverage, the DMV will send you a Certified Letter notifying you that your vehicle registration will be suspended. The suspension will take effect 10 days after the date of the mailing.

You may not drive your vehicle on public streets with a suspended registration. You can try and reinstate here Registration Reinstatement

The certified letter will contain an access code and instructions. You may also reinstate at a DMV kiosk or in person at a DMV office. You must reinstate in person if you have an SR-22 requirement as outlined under Penalties.

You must have current car insurance and meet the requirements.

Questions?

Why is car insurance so expensive in Las Vegas?

Who has the cheapest insurance in Las Vegas?

Who carries low-income car insurance in Nevada?

These and other questions answered.

Who has the cheapest car insurance in Nevada?

You might find that other web site will tell you that this company or that company has the lowest rates and they’ll list 5 of the so-called cheapest. That’s non-sense. There are so many variables in the quoting possess that changes from driver to driver and from what vehicle they’re driving or not.

We sold a non-owners policy to a customer for $15.00 a month with one of our companies named Mendota. Now that customer did live in Dayton, but still, that’s only $180. a year. Most big-name Insurance companies don’t even have this kind of policy. We don’t think you’ll find cheaper car insurance in Nevada.

How much does car insurance cost in Las Vegas?

The average cost of car insurance in Las Vegas with our Insurance Companies is $2,172.00. a year. Now let us explain. Our typical driver doesn’t have the best driving record or might even have an accident or two. For that matter, they might not even have a driver’s license, and yes we can insure them too. Their credit might not be the best and they might not have had coverage in the last 6 months.

See the other website that will show you a lower average rate but that’s for the best drivers living in the best zip codes. We help insure the average Joe living in the real world. When they won’t take you, we will.

Is car insurance expensive in Nevada?

The answer is yes and no. Depending on what state you’re coming from. Insurance is expensive, and in Nevada it sure is. We have a 24-hour community, people come here from all over the world to gamble, site see and have a good time. They drive in or fly in and rent cars. They don’t know our roads and are distracted and sometimes they get into accidents, well that raises our rates. If you’re from Kansas our rates are going to more and if you’re from New Jersey our rates are going to lower.

Listen, you can go on all the sites and try and do all the research but the easiest way is just to call us. We’ll ask you a bunch of questions that you’ll think are annoying and if we didn’t have to ask them, believe us we wouldn’t but we have to if you want to get your car insurance quote for the cheapest rate possible.

At Express Auto Insurance we’ll give it to you straight and if it’s the cheapest auto insurance in Nevada then buy it, if it’s not then you shouldn’t, because we wouldn’t either.

Is car insurance cheaper in Nevada than in California?

You should expect to pay more for car insurance once you move to Nevada. The main reason is that our state minimum required coverage is much more, so the more risk for the Insurance Companies the higher the rate. Hey, but housing is cheaper, gas is cheaper, and if you want to party all night you can do that too.

Las Vegas cheap auto insurance can be found you just have to know who to call and by luck you found us. Just give us a call and our agents here at Express Auto Insurance will try and find you the lowest auto insurance rate possible with the least amount of hassle. It’s that simple.

What is the minimum auto insurance coverage in Nevada?

The State of Nevada requires that automobile liability insurance policies carry minimum coverage of $25,000 for bodily injury or death of one person in any one accident and $50,000 for bodily injury or death of two or more persons on any one accident with $20,000 for the destruction of property of others in any one accident.

What is full coverage auto insurance in Nevada?

When people say “Full Coverage” it means different things to different people. Here in Nevada, we think of full coverage as Liability Coverage with Comprehensive and Collision Coverage. You could also add other coverages like Uninsured/Underinsured coverage, Renters Reimbursement, Roadside Assistance, and Med Pay. The choice is yours. Our agents here at Express Auto Insurance we’ll explain all these coverage’s so that you make the right decision for yourself. We don’t upsell. If you want it wonderful, if you don’t that’s great too.

How often do you have to register your car in Nevada?

Every year. You must also get your car emissions tested (smogged) and it must pass and you must also have liability insurance which you purchased in Nevada (we can help you with that) before you can register your car. New residents must register their car within the first 30 days or see a possible fine of $1000. New residents must also obtain their driver’s license within 30 days. In most new and used vehicle sales, the deadline to register the vehicle is 30 days from the date of the sale.

Can the DMV tell if you have insurance?

Yes, they can. Every Insurance company that sells auto insurance in Nevada has to report what policies they have in force to what car and what driver. Sorry, not getting around this one. We have posted on this page the possible fines you’ll receive if you don’t get car insurance coverage in Nevada.

How do I update my insurance with the DMV?

If you have your auto insurance with us, we automatically update it for you when you made your purchase. But if you feel you need to do it again you can do it here. https://dmvapp.nv.gov/dmv/vr/nvlive/nvliveinsurance/nvlive_insu_default.aspx

How long can you go without car insurance?

There is no grace period in Nevada. So the answer is 0 Days. But….here at Express Auto Insurance, we have insurance companies that will backdate a new auto insurance policy if you need to cover a lapse. Give us a call at 702 907-0000 and let’s see if we can help.

Can you register a car without insurance in Nevada?

The simple answer is no. All vehicles must have at least the state’s minimum liability coverage in place at all times if your vehicle is registered. Call us we can help.

Do I need uninsured motorist coverage in Nevada?

Nevada state law does not require you to purchase Uninsured/underinsured coverage. But you really should. It’s great coverage if you have others riding in your car and you have an accident. And it doesn’t cost all that much. You won’t regret it